Tired of being denied?

Start Removing Negative Items and Boost Your Score Today!

Our proven credit repair strategies help you remove

negative items, boost your score, and take back control of your financial future — starting today.

Join over 1,700 individuals who've transformed their credit without hidden fees or prolonged waiting periods.

Ready for a 720+ score? Get started with a FREE credit review!

Ready for a 720+ score? Get started with a FREE credit review!

Join over 1,700 individuals who've transformed their credit without hidden fees or prolonged waiting periods.

Tired of being denied?

Start removing negative items and boosting your score today

Our proven credit repair strategies help you remove

negative items, boost your score, and take back control of your financial future — starting today..

Is Poor Credit Holding You Back?

If you've faced challenges like...

Credit Card Rejections

High Interest

Low Limits

Rental Rejection

Job Disqualification

Utility Deposits

Phone Denials

Insurance Hikes

Co-Signer Needed

You're not alone. Many have encountered these hurdles, but there's a path forward.

Introducing Our Proven Credit Repair System

Our approach includes:

Personalized

Credit Analysis

We take a deep dive into your credit report to identify problem areas, opportunities for quick wins, and strategies tailored to your

unique financial goals.

Dispute Resolution

with Credit Bureaus

We communicate directly with Experian, Equifax, and TransUnion to challenge inaccurate, outdated, or unverifiable negative items.

Access to

New Tradelines

Boost your credit score by being added to established credit accounts that report positive payment history — improving age and utilization.

Education on

Credit Management

We empower you with practical tips and strategies to maintain and grow your credit —

so you stay in control long after the repair.

Is Poor Credit Holding You Back?

If you've faced challenges like

Credit Card Rejections

High Interest

Low Limits

Rental Rejection

Job Disqualification

Utility Deposits

Phone Denials

Insurance Hikes

Co-Signer Needed

You're not alone. Many have encountered these hurdles, but there's a path forward.

Introducing Our Proven Credit Repair System

Our approach includes:

Personalized

Credit Analysis

We take a deep dive into your credit report to identify problem areas, opportunities for quick wins, and strategies tailored to your

unique financial goals.

Dispute Resolution with Credit Bureaus

We communicate directly with Experian, Equifax, and TransUnion to challenge inaccurate, outdated, or unverifiable negative items.

Access to

New Tradelines

Boost your credit score by being added to established credit accounts that report positive payment history — improving age and utilization.

Education on

Credit Management

We empower you with practical tips and strategies to maintain and grow your credit —

so you stay in control long after the repair.

Your 3-Step Journey to Better Credit

Free Credit Audit

Identify inaccuracies and areas for improvement.

Activate Repair Plan

Implement strategies tailored to your unique financial situation.

Financial Freedom

Benefit from improved credit scores and new opportunities.

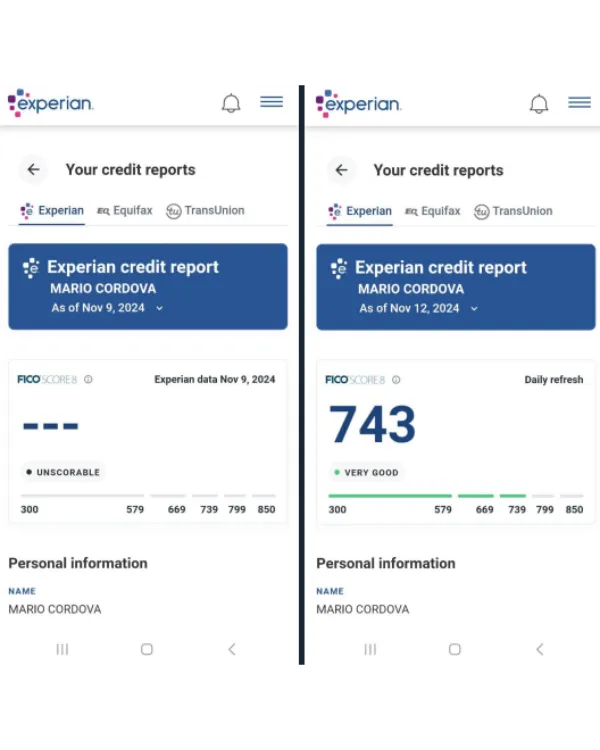

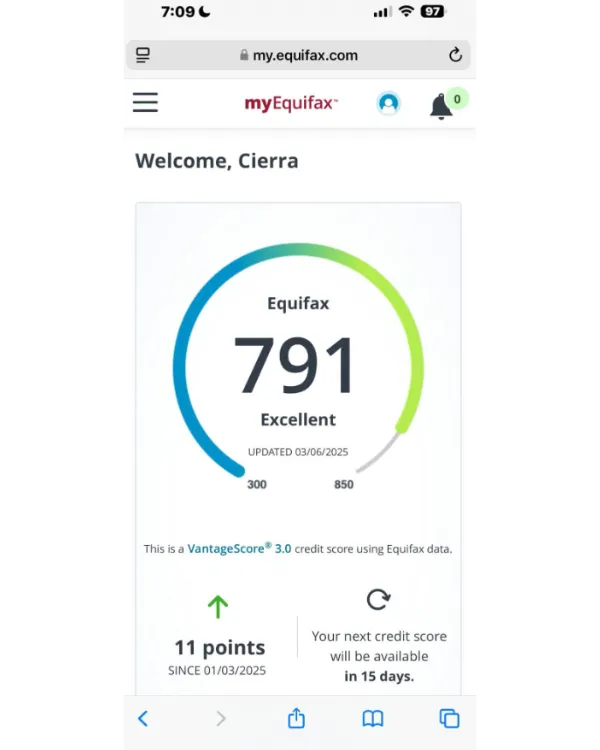

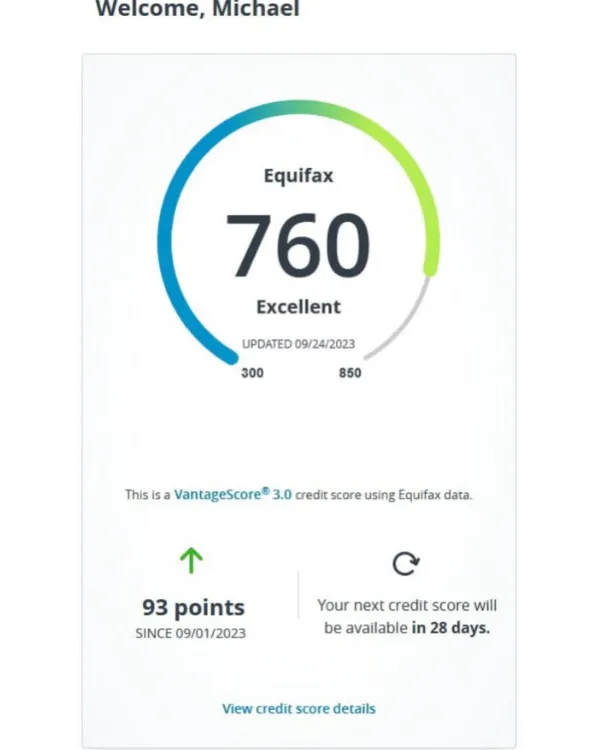

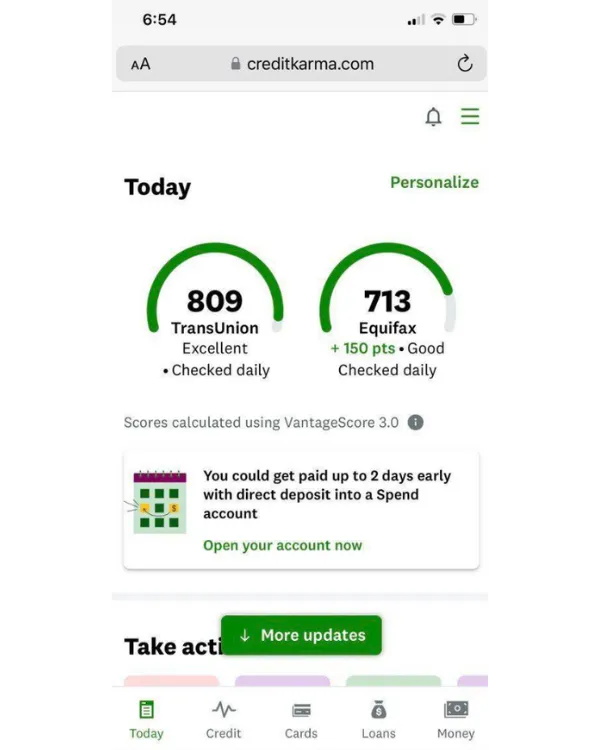

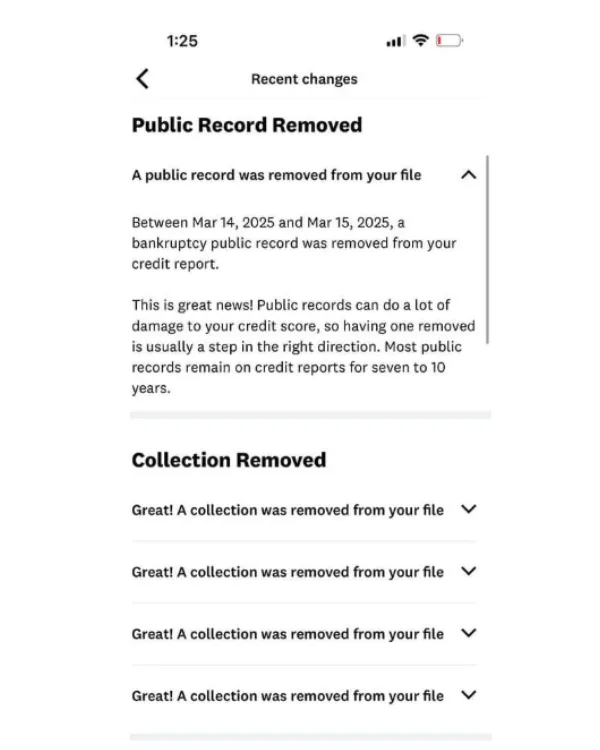

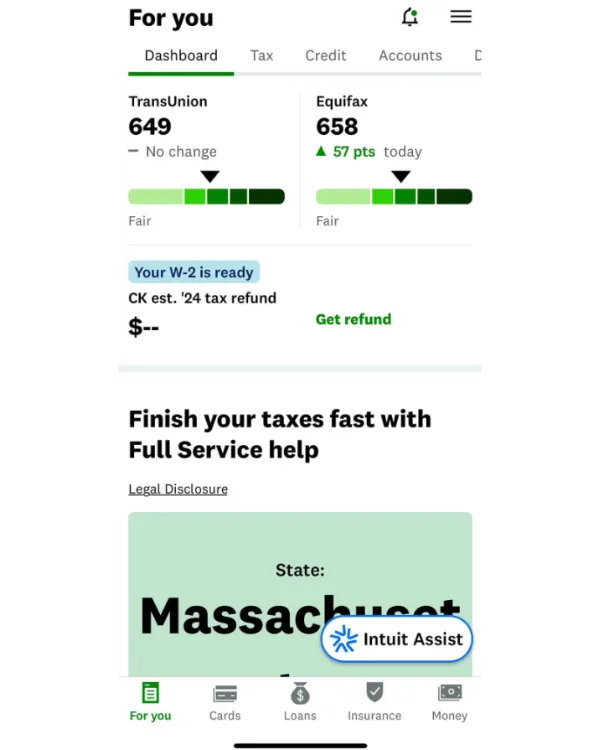

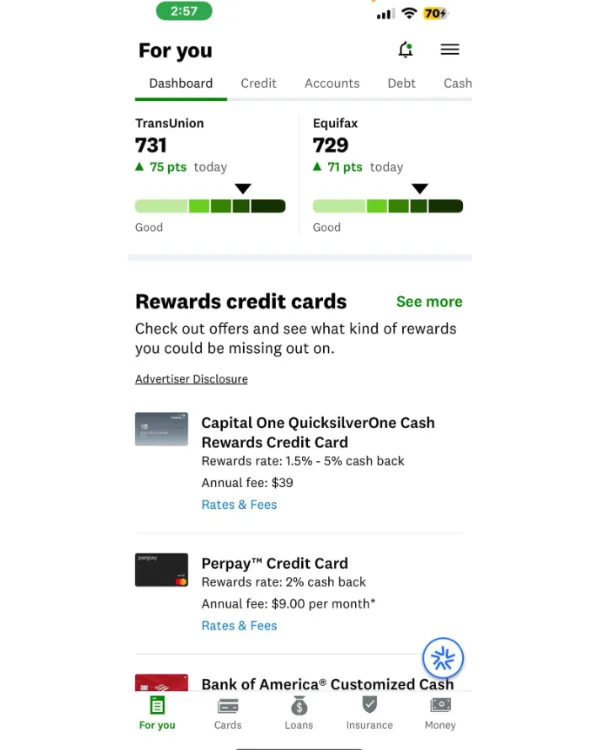

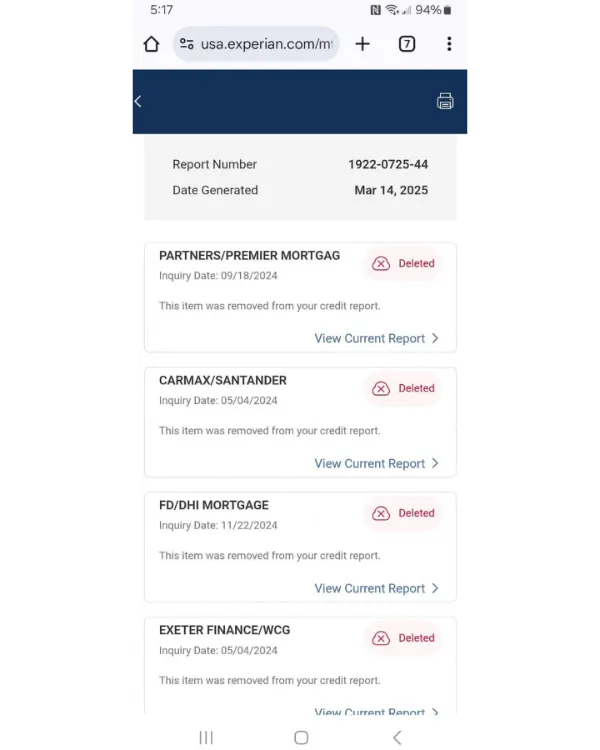

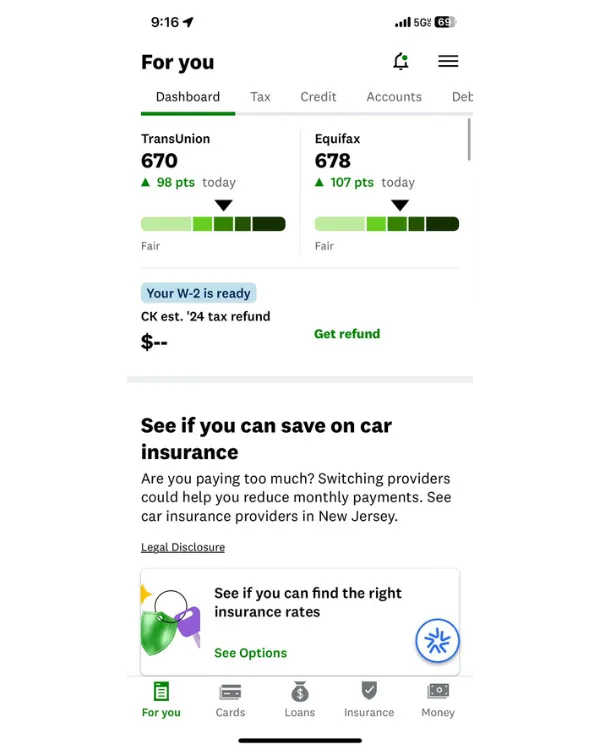

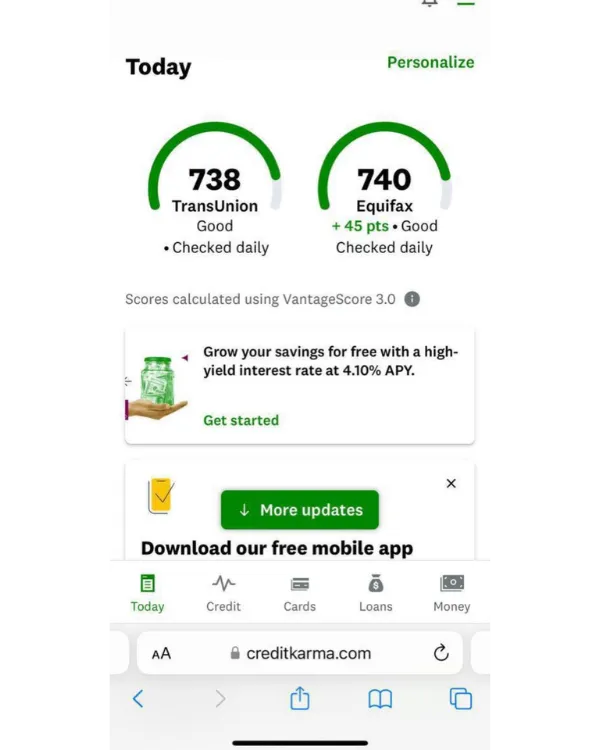

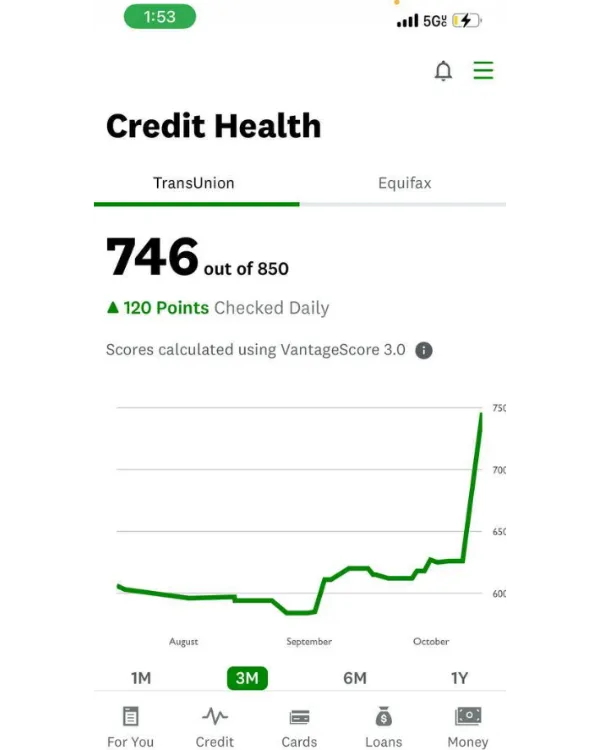

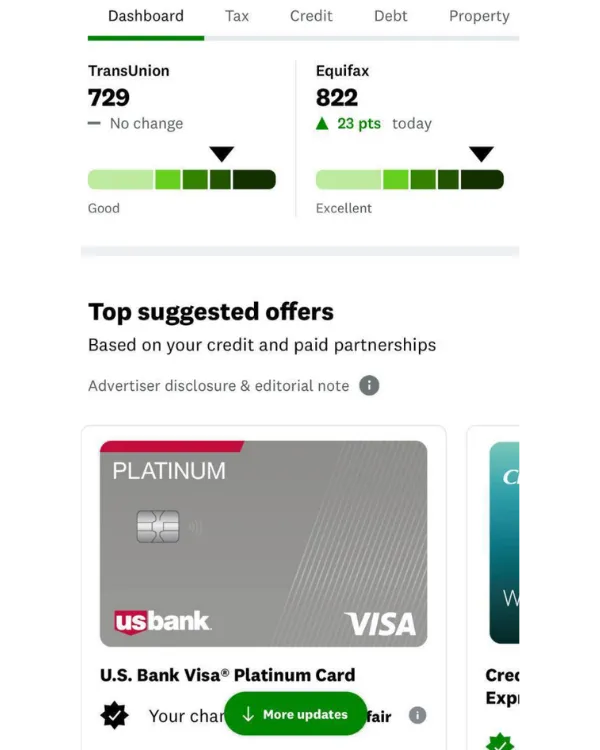

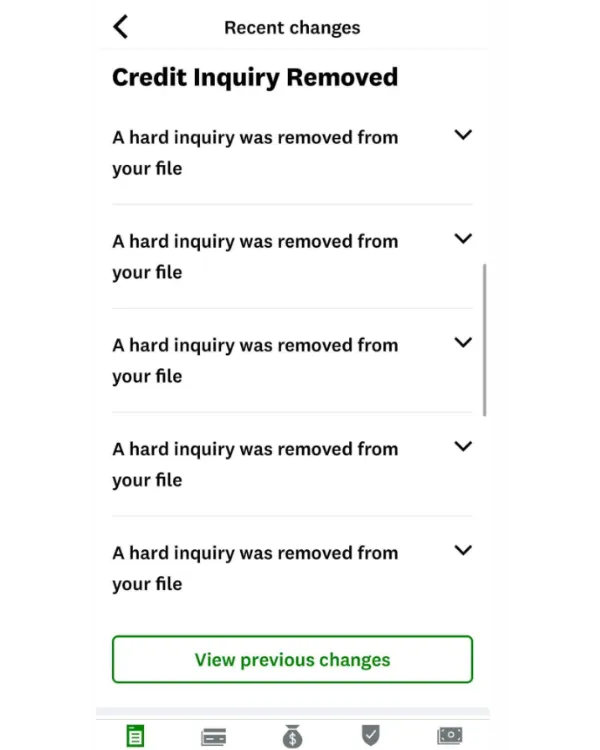

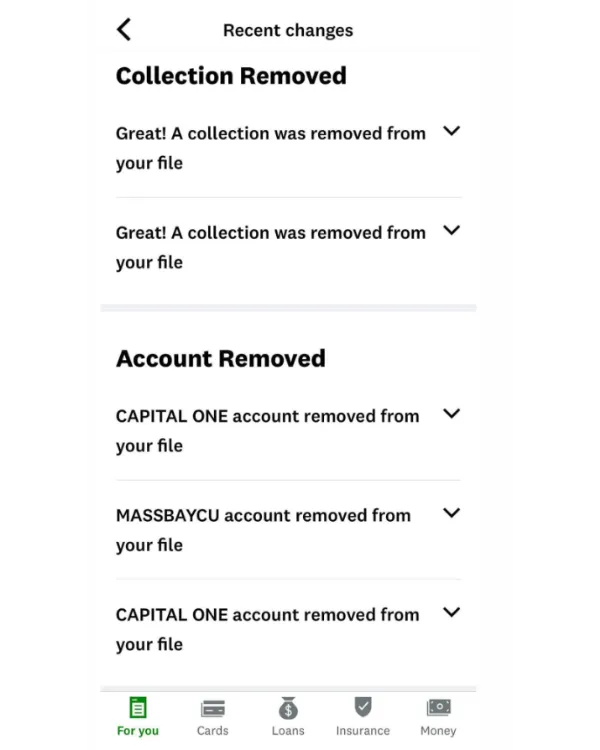

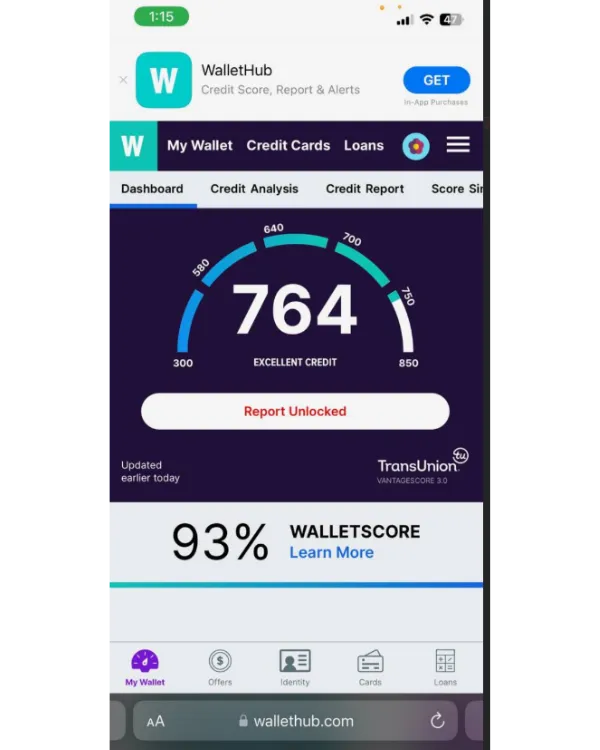

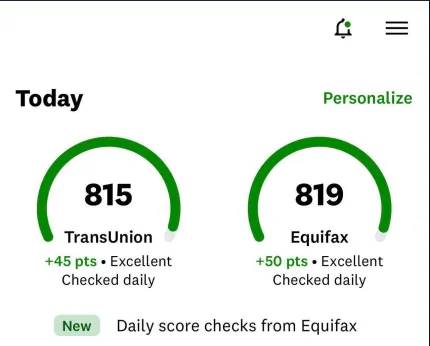

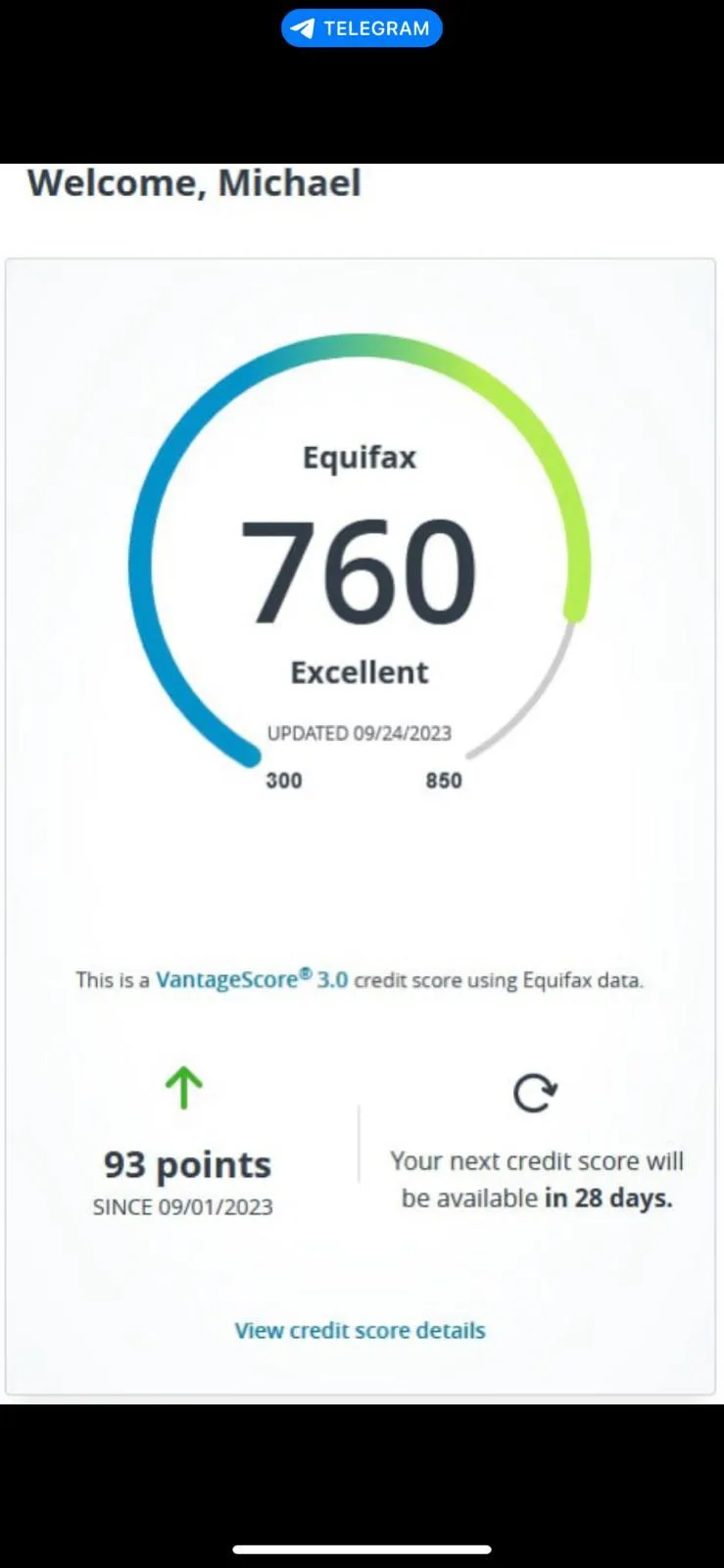

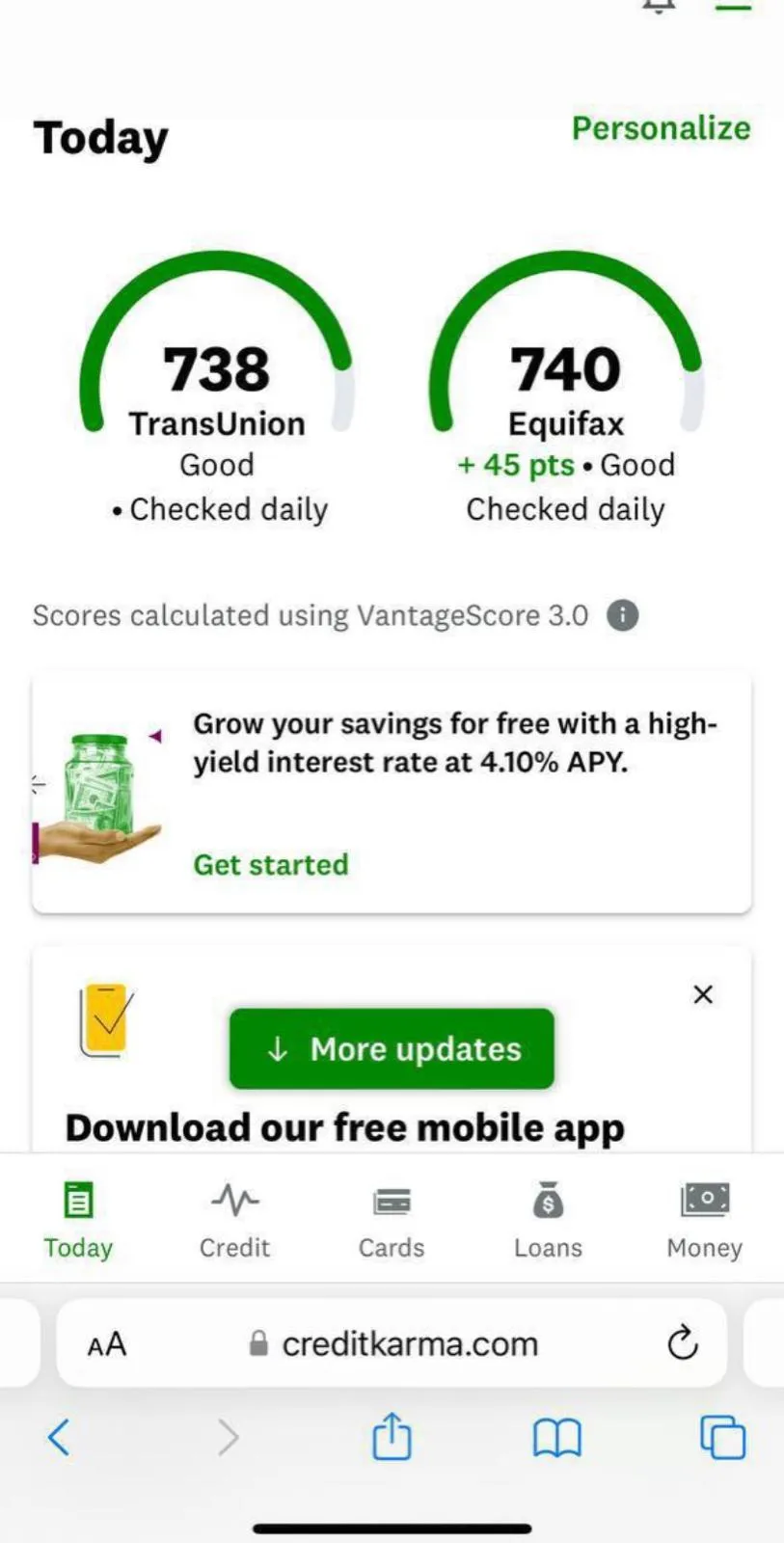

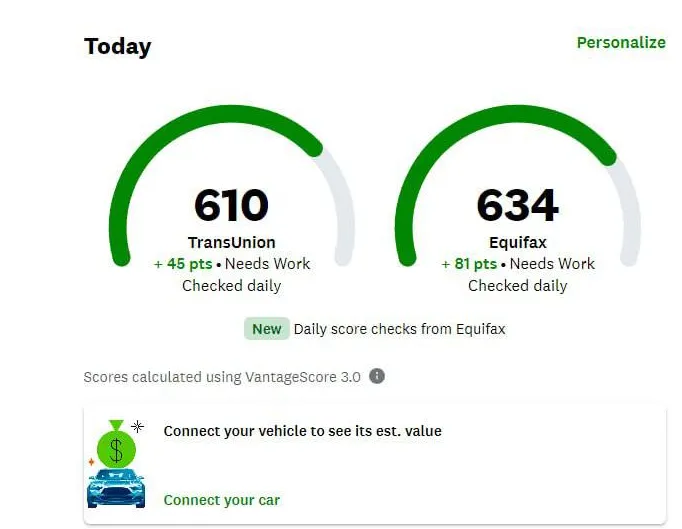

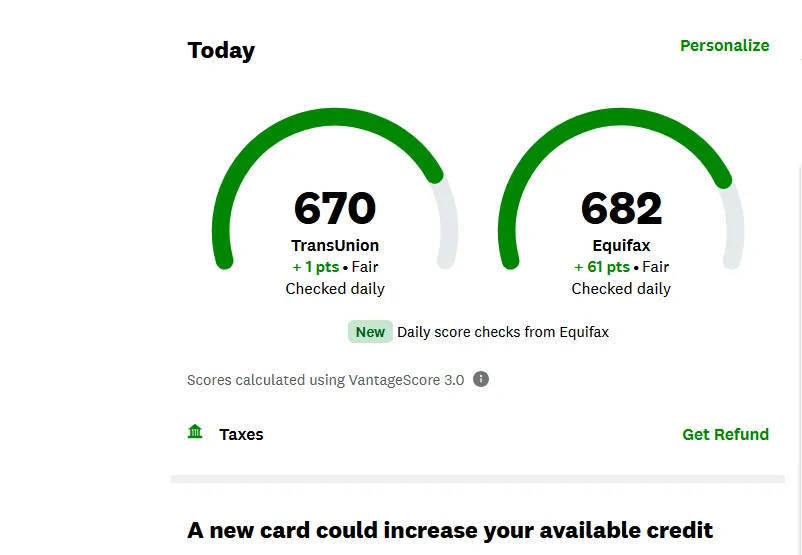

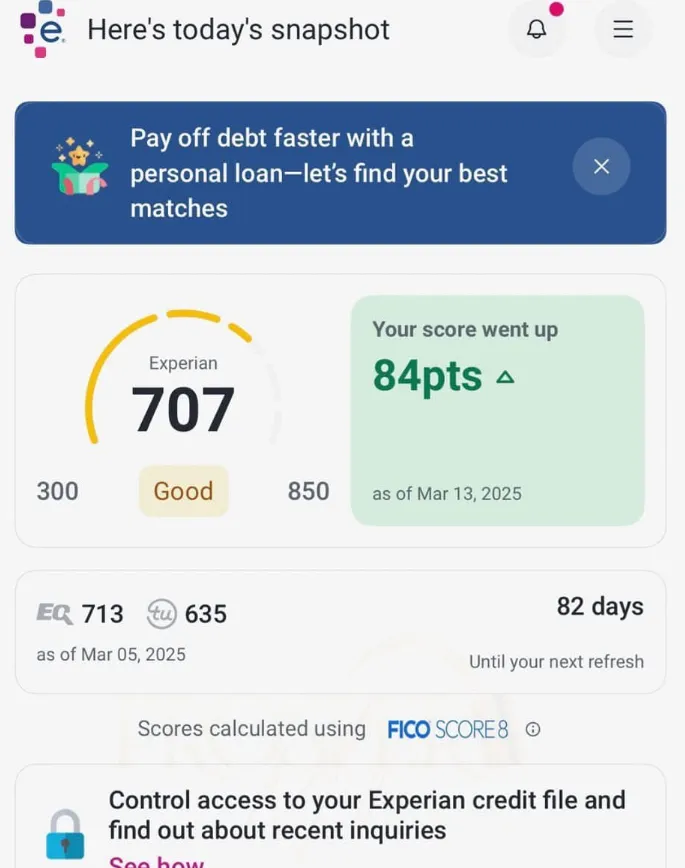

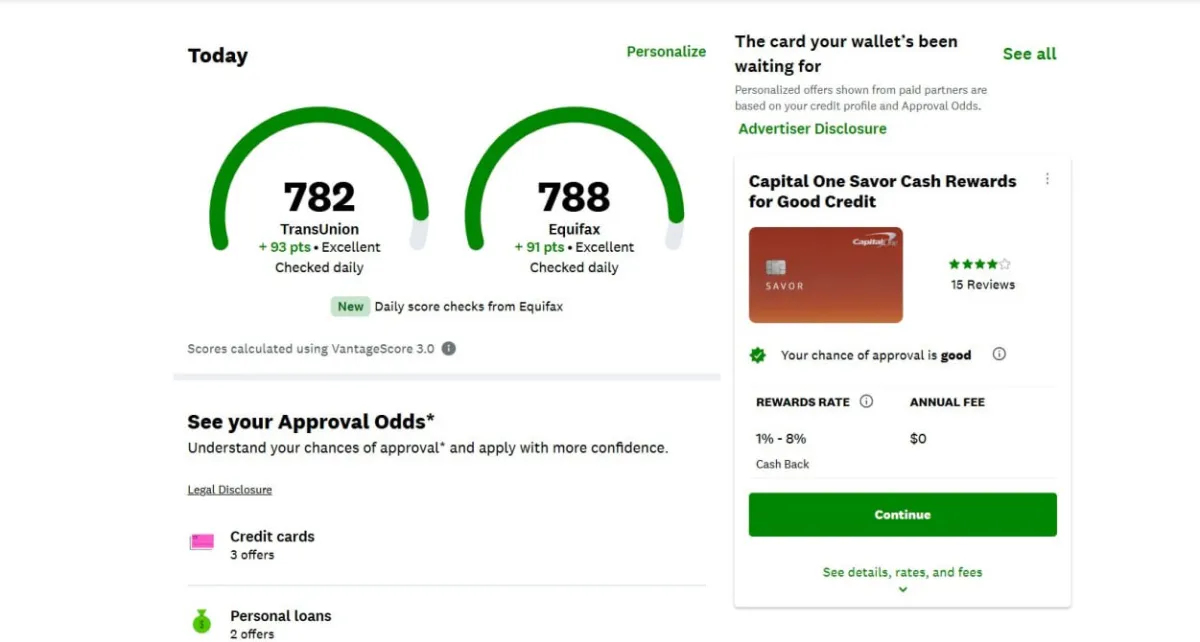

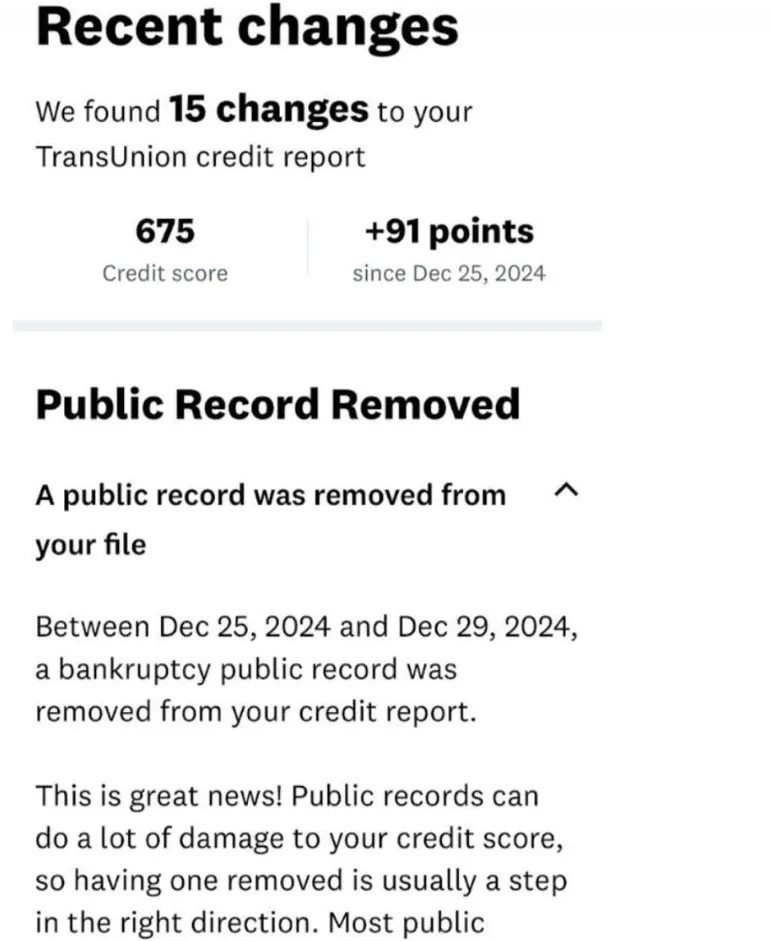

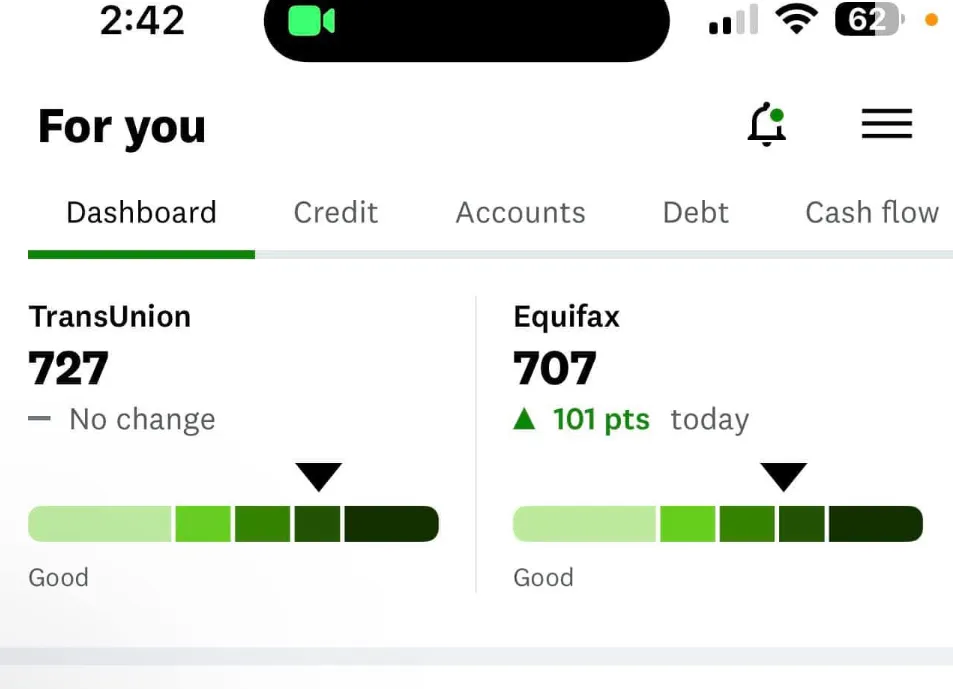

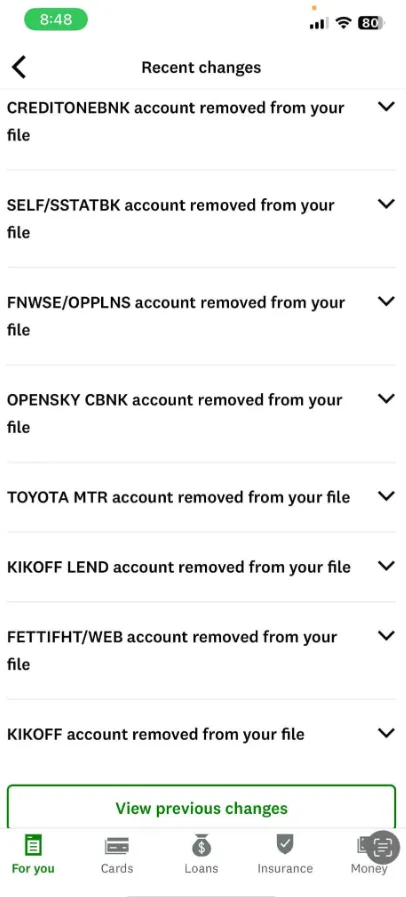

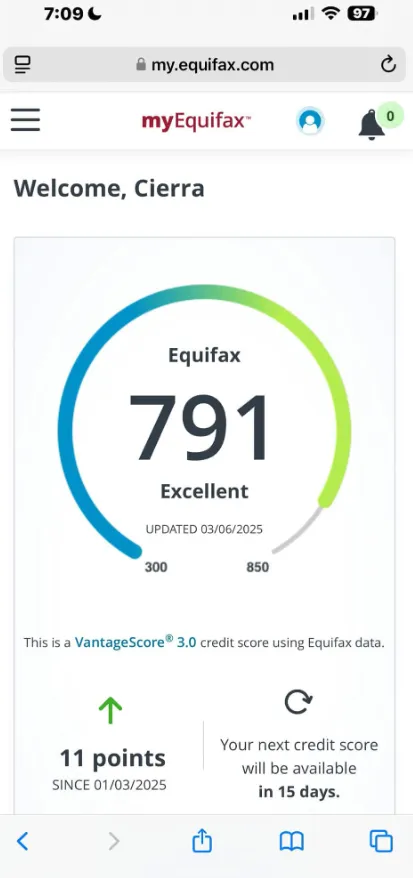

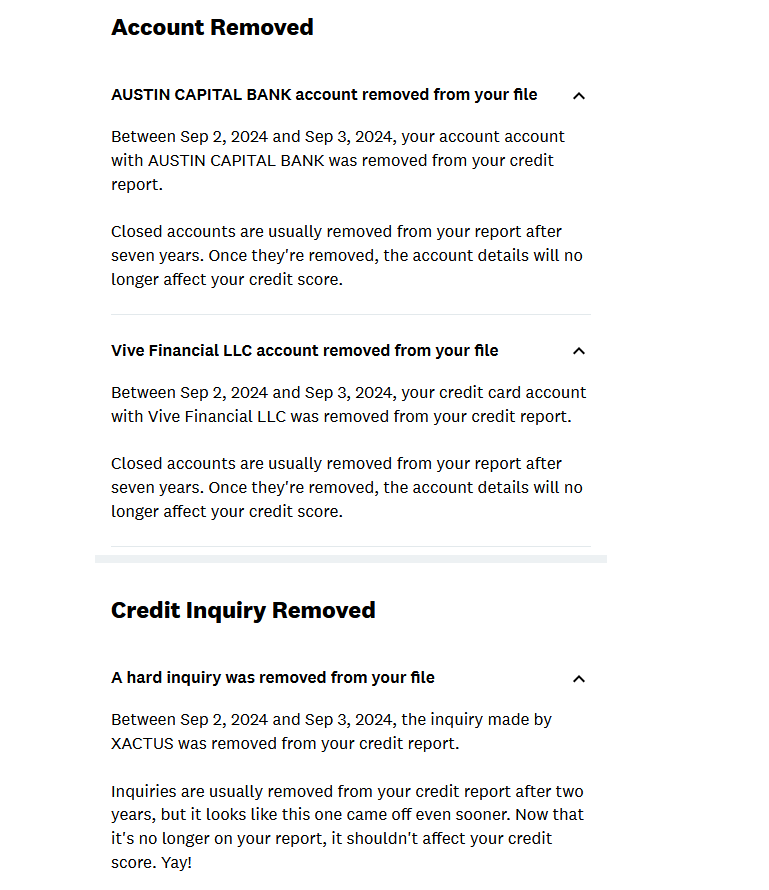

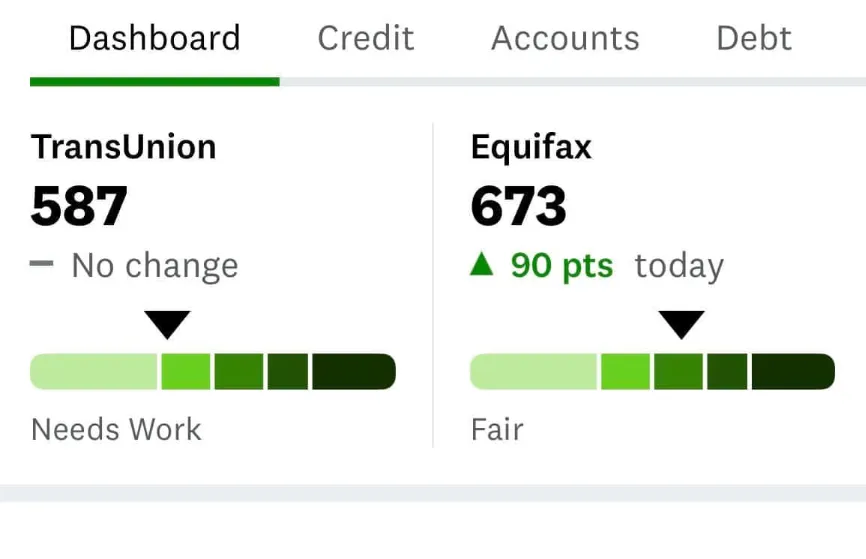

Case Study

Unlock the Advantages of Good Credit

With improved credit, you can...

Secure Loans with

Favorable Terms

Lower interest rates,

higher approvals, and

more financial freedom.

Access Premium

Credit Cards

Get approved for cards

with higher limits, cash back,

travel perks, and more.

Negotiate Better

Insurance Rates

Creditworthiness can lower

your premiums for auto, home,

and life insurance.

Achieve Financial

Peace of Mind

Say goodbye to stress, fear,

and denial — and hello

to confidence and control.

The Hidden Cost of Bad Credit

Your Credit Score Is Costing You a Fortune Every Single Day

Most people have no idea that their credit score is silently draining thousands from their bank account. While you're focused on your daily expenses, bad credit is working against you 24/7, making everything more expensive and keeping opportunities just out of reach.

The Shocking Reality of Bad Credit

$200,000+ lifetime penalty - Average amount people with poor credit pay extra over their lifetime in higher interest rates alone

18-29% credit card interest vs. 12-16% for good credit (that's $2,400 more per year on a $10,000 balance)

$500-2,000 extra annually in insurance premiums due to credit-based pricing

$1,000-5,000 security deposits for utilities, cell phones, and apartments that good credit eliminates

3x higher auto loan rates - paying $8,000-15,000 more for the same car

Mortgage rejection rate of 73% for scores below 620 vs. 96% approval for scores above 740

What Good Credit Unlocks

Access to 0% APR credit cards and promotional financing

Premium rewards programs that put money back in your pocket

Pre-approved mortgage rates as low as 3-4% instead of 7-12%

No security deposits required for rentals, utilities, or services

Employment opportunities - 47% of employers check credit for hiring decisions

Better insurance rates saving $100-200 monthly on auto and home coverage

The question isn't whether you can afford to fix your credit - it's whether you can afford NOT to.

Why DIY Credit Repair Usually Fails

The Credit Repair Mistakes That Keep You Stuck in the Same Score Range

You've probably tried fixing your credit yourself. Maybe you disputed a few items online, paid off some debt, or even closed old accounts thinking it would help. Yet your score barely budged, or worse - it went down. You're not alone, and it's not your fault.

Why 78% of DIY Credit Repair

Attempts Fail

Wrong dispute strategy - Generic online disputes get automatically rejected 87% of the time

Timing mistakes - Disputing everything at once triggers fraud alerts and account freezes

Missing legal leverage - Not knowing which consumer protection laws apply to your situation

Creditor tactics - Debt collectors use 23 different stalling techniques most people don't recognize

Credit utilization errors - 43% harm their credit scores while trying to fix them themselves.

Incomplete documentation - Missing one piece of evidence can invalidate an entire dispute case

The Professional

Advantage

Advanced dispute strategies - We know which approaches work for each credit bureau

Legal compliance expertise - Using FCRA, FDCPA, and state laws to force removals

Creditor relationships - Direct contacts with decision-makers, not customer service

Systematic approach - Strategic timing that maximizes results without triggering red flags

Ongoing monitoring - Catching new negative items before they damage your progress

Backup documentation - Professional-grade record keeping that stands up to scrutiny

At ReStart 4 U, we've seen what works and what doesn't. Our systematic approach gets results because we've eliminated the guesswork.

Your Credit Transformation Starts Here

How ReStart 4 U Turns Credit Disasters Into Success Stories

Every month, we help people break free from the credit prison that's been holding them back.

Our clients don't just see number improvements - they see life improvements. Better rates, bigger approvals, and the confidence that comes with knowing their credit is an asset, not a liability.

What Makes ReStart 4 U Different

Personalized strategy - No cookie-cutter approaches; every plan is built for your unique situation

Fast-track results - Most clients see improvements within 30-45 days of starting

Comprehensive approach - We handle disputes, negotiations, and credit building simultaneously

Transparent process - Monthly progress reports showing exactly what we've accomplished

Educational support - You'll understand your credit better than 95% of Americans

Lifetime maintenance - Once we fix it, we help you keep it perfect

Your Investment VS. Your Return

Average client saves $3,200 in the first year alone through better rates

Typical home buyer saves $87,000 over the life of their mortgage

Auto loan improvements average $4,500-8,000 in total savings

Insurance rate reductions save $150-250 monthly

Credit card interest savings of $200-500 per month for active users

The cost of our service is recovered in savings within the first 90 days for most clients.

Real Results From Real Clients

"487 to 721 in 6 months, approved for $285,000 dream home."

- Sarah M.

"Removed $47,000 in collections, qualified for business loan"

- Marcus T.

"542 to 689 in 4 months, saved $18,000 on car financing."

- Jennifer L.

"Went from apartment rejections to approved for luxury condo"

- David R.

"Credit card approvals went from $0 to $85,000 in available credit."

- Lisa K.

The Hidden Cost of Bad Credit

Your Credit Score Is Costing You a Fortune Every Single Day

Most people have no idea that their credit score is silently draining thousands from their bank account.

While you're focused on your daily expenses, bad credit is working against you 24/7,

making everything more expensive and keeping opportunities just out of reach.

The Shocking Reality of Bad Credit

$200,000+ lifetime penalty - Average amount people with poor credit pay extra over their lifetime in higher interest rates alone

18-29% credit card interest vs. 12-16% for good credit (that's $2,400 more per year on a $10,000 balance)

$500-2,000 extra annually in insurance premiums due to credit-based pricing

$1,000-5,000 security deposits for utilities, cell phones, and apartments that good credit eliminates

3x higher auto loan rates - paying $8,000-15,000 more for the same car

Mortgage rejection rate of 73% for scores below 620 vs. 96% approval for scores above 740

What Good Credit

Unlocks

Access to 0% APR credit cards and promotional financing

Premium rewards programs that put money back in your pocket

Pre-approved mortgage rates as low as 3-4% instead of 7-12%

No security deposits required for rentals, utilities, or services

Employment opportunities - 47% of employers check credit for hiring decisions

Better insurance rates saving $100-200 monthly on auto and home coverage

The question isn't whether you can afford to fix your credit - it's whether you can afford NOT to

Why DIY Credit Repair Usually Fails

The Credit Repair Mistakes That Keep You Stuck in the Same Score Range

You've probably tried fixing your credit yourself. Maybe you disputed a few items online,

paid off some debt, or even closed old accounts thinking it would help. Yet your score barely budged,

or worse - it went down. You're not alone, and it's not your fault.

Why 78% of DIY Credit Repair Attempts Fail

Wrong dispute strategy - Generic online disputes get automatically rejected 87% of the time

Timing mistakes - Disputing everything at once triggers fraud alerts and account freezes

Missing legal leverage - Not knowing which consumer protection laws apply to your situation

Creditor tactics - Debt collectors use 23 different stalling techniques most people don't recognize

Credit utilization errors - 43% harm their credit scores while trying to fix them themselves.

Incomplete documentation - Missing one piece of evidence can invalidate an entire dispute case

The Professional

Advantage

Advanced dispute strategies - We know which approaches work for each credit bureau

Legal compliance expertise - Using FCRA, FDCPA, and state laws to force removals

Creditor relationships - Direct contacts with decision-makers, not customer service

Systematic approach - Strategic timing that maximizes results without triggering red flags

Ongoing monitoring - Catching new negative items before they damage your progress

Backup documentation - Professional-grade record keeping that stands up to scrutiny

At ReStart 4 U, we've seen what works and what doesn't. Our systematic approach gets results because we've eliminated the guesswork.

Your Credit Transformation

Starts Here

How ReStart 4 U Turns Credit Disasters Into Success Stories

Every month, we help people break free from the credit prison that's been holding them back.

Our clients don't just see number improvements - they see life improvements. Better rates, bigger approvals, and the confidence that comes with knowing their credit is an asset, not a liability.

What Makes ReStart 4 U Different

Personalized strategy - No cookie-cutter approaches; every plan is built for your unique situation

Fast-track results - Most clients see improvements within 30-45 days of starting

Comprehensive approach - We handle disputes, negotiations, and credit building simultaneously

Transparent process - Monthly progress reports showing exactly what we've accomplished

Educational support - You'll understand your credit better than 95% of Americans

Lifetime maintenance - Once we fix it, we help you keep it perfect

Your Investment VS.

Your Return

Average client saves $3,200 in the first year alone through better rates

Typical home buyer saves $87,000 over the life of their mortgage

Auto loan improvements average $4,500-8,000 in total savings

Insurance rate reductions save $150-250 monthly

Credit card interest savings of $200-500 per month for active users

The cost of our service is recovered in savings within the first 90 days for most clients.

Real Results From

Real Clients

"487 to 721 in 6 months, approved for $285,000 dream home."

- Sarah M.

"Removed $47,000 in collections, qualified for business loan"

- Marcus T.

"542 to 689 in 4 months, saved $18,000 on car financing."

- Jennifer L.

"Went from apartment rejections to approved for luxury condo"

- David R.

"Credit card approvals went from $0 to $85,000 in available credit."

- Lisa K.

Our Pricing

Improving your credit score isn’t always straightforward. It involves multiple steps, dealing with credit bureaus and creditors, and managing complex paperwork. To see real results, you need the right knowledge, time, and persistence on your side.

FREE CONSULTATION

Free

15-Minute Consultation

What does the consultation include?

We will go over details of your report and pinpoint what is hurting your credit. No obligation.

THE REMOVE PACKAGE

$1000

FULL CREDIT REPAIR

GUARANTEED RESULTS OR YOUR MONEY BACK!WE HELP CLIENTS REMOVE

Credit Card Debt

Foreclosures

Repossessions

Child Support

Student Loans

Medical Bills

Evictions

Late Payments

Inquiries

And More!

WITH THE REMOVE PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for credit cards/loans

Get approved for a new car

Get approved for a new apartment/home

Finance their next cosmetic surgery

Finance jewelry

THE REBUILD PACKAGE

$1500

INCLUDES EVERYTHING FROM “THE REMOVE PACKAGE”

Our Team Has Helped Clients Get Approved For Personal funding Of Up To $50,000 By Cleaning And Building Their Credit Report.

WITH THE REBUILD PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for larger credit cards/loans

Get approved for luxury cars up to $100k

Get approved for a new apartment/home

Start a new business/fund your current business

Invest in real estate

Finance cosmetic surgery

Finance jewelry

Immediately build 2-3 years of credit history

INCLUDES our unstoppable eBooks designed to keep your credit flawless in perpetuity

THE RESTART PACKAGE

$2000

INCLUDES EVERYTHING FROM “THE REBUILD PACKAGE”

Our Team Has Helped Clients Get Approved For Personal funding & Business Funding Of Up To $100,000 By Cleaning, Structuring & Rebuilding Their Credit Report.

WITH THE RESTART PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for credit cards/loans up to $100k

Get approved for luxury cars up to $250k

Get approved for a new apartment/home

Start a new business/fund your current business

Invest in real estate plays

Finance their next cosmetic surgery

Finance jewelry

Immediately build 3-5 years of credit history

INCLUDES our unstoppable eBooks designed to keep your credit and banking history flawless in perpetuity

INCLUDES our tradeline ebooks designed to continuously overhaul your credit history and report

INCLUDES secret banking instructions to create relationships needed for maximum funding

Get Your Credit Consultation Now

Our Pricing

Improving your credit score isn’t always straightforward. It involves multiple steps, dealing with credit bureaus and creditors, and managing complex paperwork. To see real results, you need the right knowledge, time, and persistence on your side.

FREE CONSULTATION

Free

15-Minute Consultation

What does the consultation include?

We will go over details of your report and pinpoint what is hurting your credit. No obligation.

THE REMOVE PACKAGE

$1000

FULL CREDIT REPAIR

GUARANTEED RESULTS OR YOUR MONEY BACK!WE HELP CLIENTS REMOVE

Credit Card Debt

Foreclosures

Repossessions

Child Support

Student Loans

Medical Bills

Evictions

Late Payments

Inquiries

And More!

WITH THE REMOVE PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for credit cards/loans

Get approved for a new car

Get approved for a new apartment/home

Finance their next cosmetic surgery

Finance jewelry

THE REBUILD PACKAGE

$1500

INCLUDES EVERYTHING FROM “THE REMOVE PACKAGE”

Our Team Has Helped Clients Get Approved For Personal funding Of Up To $50,000 By Cleaning And Building Their Credit Report.

WITH THE REBUILD PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for larger credit cards/loans

Get approved for luxury cars up to $100k

Get approved for a new apartment/home

Start a new business/fund your current business

Invest in real estate

Finance cosmetic surgery

Finance jewelry

Immediately build 2-3 years of credit history

INCLUDES our unstoppable eBooks designed to keep your credit flawless in perpetuity

THE RESTART PACKAGE

$2000

INCLUDES EVERYTHING FROM “THE REBUILD PACKAGE”

Our Team Has Helped Clients Get Approved For Personal funding & Business Funding Of Up To $100,000 By Cleaning, Structuring & Rebuilding Their Credit Report.

WITH THE RESTART PACKAGE, WE’VE HELPED CLIENTS BE ABLE TO:

Get approved for credit cards/loans up to $100k

Get approved for luxury cars up to $250k

Get approved for a new apartment/home

Start a new business/fund your current business

Invest in real estate plays

Finance their next cosmetic surgery

Finance jewelry

Immediately build 3-5 years of credit history

INCLUDES our unstoppable eBooks designed to keep your credit and banking history flawless in perpetuity

INCLUDES our tradeline e-books designed to continuously overhaul your credit history and report

INCLUDES secret banking instructions to create relationships needed for maximum funding

Get Your Credit Consultation Now

Frequently Asked Questions

Can bad credit really be fixed, or am I stuck with it forever?

Yes, it can absolutely be fixed. At ReStart 4 U, we’ve helped clients go from low 400s to

mid-700s by using our proven, proprietary credit repair strategies. Credit reports are not

static—they’re legally required to be accurate, verifiable, and timely. If any item doesn’t

meet these standards, we challenge and remove it. You’re not stuck—you just need the right

team in your corner.

How long does it take to see results?

Credit repair is not a magic switch—but with ReStart 4 U, most clients begin seeing results in as

little as 30–45 days, depending on the complexity of the profile. We've engineered a fast-track

dispute process that targets the most damaging items first for quick impact. Some clients even

experience multiple deletions within the first round.

What makes ReStart 4 U different from other credit repair companies?

We don’t use cookie-cutter software or passive disputes. ReStart 4 U has over 15 years of

hands-on experience using aggressive yet compliant tactics that actually get results. We

adjust to industry shifts, use proprietary methods tailored to your situation, and we’re

performance-driven—not subscription-based. Our mission is to get you OUT of the

program, not keep you in it.

I’ve already tried credit repair and it didn’t work. What makes you think

you can help me?

We hear this a lot—and we get it. Many companies simply send generic letters and hope for the

best. At ReStart 4 U, we dig deeper. We conduct a full audit of your credit reports, analyze

data furnishers, and craft custom legal disputes backed by FCRA, FDCPA, and CFPB

standards. If we take on your file, it’s because we know we can help.

Can you remove collections, charge-offs, repossessions, or bankruptcies?

Yes—if it’s inaccurate, outdated, unverifiable, or violates your consumer rights, we can

legally demand its deletion. We’ve successfully removed collections, repossessions, late

payments, charge-offs, foreclosures—even bankruptcies. Every negative item is

approached differently, and we apply the most effective strategy for each.

Will you help me build new credit while repairing the old?

Absolutely. Credit repair without rebuilding is incomplete. We provide guidance on adding

positive tradelines, secured credit cards, credit builder accounts, and more. We also help

you structure your credit profile to appeal to lenders once your scores rise. Our goal is not

just deletion—but total credit optimization.

Is credit repair legal?

Yes, 100%. Under the Fair Credit Reporting Act (FCRA), you have the legal right to dispute

any item on your credit report that’s inaccurate, incomplete, or unverifiable. At ReStart 4 U, we

operate fully within federal and state laws—and our strategies are not only legal, they’re based

on decades of compliance-backed experience.

Will this work if I have no credit history at all?

Yes. Whether you’re just starting out or rebuilding from scratch, we help you establish a strong

credit foundation using positive accounts and reporting tools. Many of our clients go from thin

files to approved financing in under 6 months when following our roadmap.

What credit bureaus do you work with?

We work directly with all three major credit bureaus: Equifax, Experian, and TransUnion. Our

strategies are uniquely crafted to handle how each bureau responds and updates their

reporting. We also dispute directly with furnishers and collection agencies for maximum

impact.

How do I know this isn’t a scam? There are so many shady companies out there.

ReStart 4 U has been in business for over 15 years with a strong reputation built on results,

transparency, and integrity. We provide clear documentation, updates, and

performance-based proof of progress. We don’t hide behind fine print—we deliver results or

you don’t pay.

Will I have access to someone throughout the process?

Yes. Every ReStart 4 U client gets assigned a dedicated credit expert who will walk you

through every step. You’ll receive regular progress updates, customized recommendations, and

real-time support. We believe in clear communication and client empowerment—not leaving

you in the dark.

How much will this cost me?

We offer affordable packages and a performance-based model—you only pay for results. Our

pricing reflects the value, expertise, and speed we bring to the table. Investing in your credit

now will save you thousands in interest, denials, and missed opportunities later.

Can you help me qualify for a mortgage, auto loan, or business funding?

Yes. Many of our clients come to us specifically to get qualified for big financial goals. We

reverse-engineer the process to build a credit profile lenders love to approve. Whether you're

trying to buy a home, start a business, or finance a vehicle, we help you get credit-ready and

fundable.

Do I need to do anything while you’re working on my credit?

Yes, but it’s simple. We’ll give you a Credit Action Plan with easy-to-follow steps like avoiding

new inquiries, making on-time payments, and adding strategic tradelines. Your success is a

partnership—and we set you up to win.

What happens after my credit is repaired?

Our work doesn’t stop at deletions. We help you build strong credit habits, maintain your

improved score, and prepare for future approvals. Many clients stay connected with us

long-term as they move on to homeownership, entrepreneurship, and investing. ReStart isn’t

just about credit—it’s about financial freedom.

Meet The Team

COMPANY

CUSTOMER CARE

ReStart4U Headquarters

LEGAL

Connect With Us

Copyright 2026 | ReStart 4 u | All Rights Reserved

COMPANY

CUSTOMER CARE

ReStart4U Headquarters

LEGAL

Connect With Us

Copyright 2026. ReStart 4 u. All Rights Reserved.